Ungated

The Pattern Behind the Presidency

Here’s what no one tells you about Donald Trump’s six bankruptcies: they worked.

Not as business strategy. As regulation. They were the thing that said stop.

When he couldn’t make the $47 million interest payment on the Taj Mahal, he didn’t decide to restructure. The bankruptcy court made him. When his casinos were cannibalizing each other and the math had been wrong from the start—an analyst told him before opening day that no casino in history could generate what he’d need to cover the debt—he didn’t course correct. He had the analyst fired. The courts course corrected for him, later, after the wreckage.

This is the pattern, and it goes back fifty years. Not a man who fails and learns. A man who drives until something external stops him. Then adapts. Then drives again, faster, with fewer things in the way.

His father understood this. Fred Trump was in the office every day until he went to the hospital. He was “behind Donald in every way, shape and form, including financing.” But financing was the least of it. Fred was the gating mechanism—the thing that evaluated, sequenced, said not yet or not that one or the math doesn’t work. The early deals worked because Fred’s judgment was still in the loop. Trump Tower, the Grand Hyatt—these weren’t Donald’s judgment vindicated. They were Fred’s architecture still holding.

Then Fred declined. By the late 1980s he was in his eighties, coming downstairs wearing three ties, his mind going. Donald’s decisions went ungated on the same schedule. The Taj Mahal. The Shuttle. The USFL. Three casinos competing against each other in the same city. Every analyst who looked at the numbers said the same thing: this doesn’t work. Every one of them was ignored or attacked.

In December 1990, Fred—85, diminished, still trying—sent a lawyer to the Trump Castle casino with a certified check. The lawyer bought $3.5 million in chips at a blackjack table and left without gambling. An illegal loan disguised as a purchase. Enough for one interest payment. Fred’s last intervention—the final act of a father who had been the external structure his son’s cognition required.

Seven months later: Chapter 11.

But here’s what matters: the bankruptcy didn’t break the pattern. It replaced Fred.

The courts did what Fred had done. They imposed structure from outside. They said: you will restructure this debt, you will give up this equity, you will operate under these conditions. They provided the sequencing and evaluation that wasn’t coming from inside.

And the walls were close. Overextend, and within eighteen months you’re in front of a judge. The drive couldn’t build much velocity because the stops came fast.

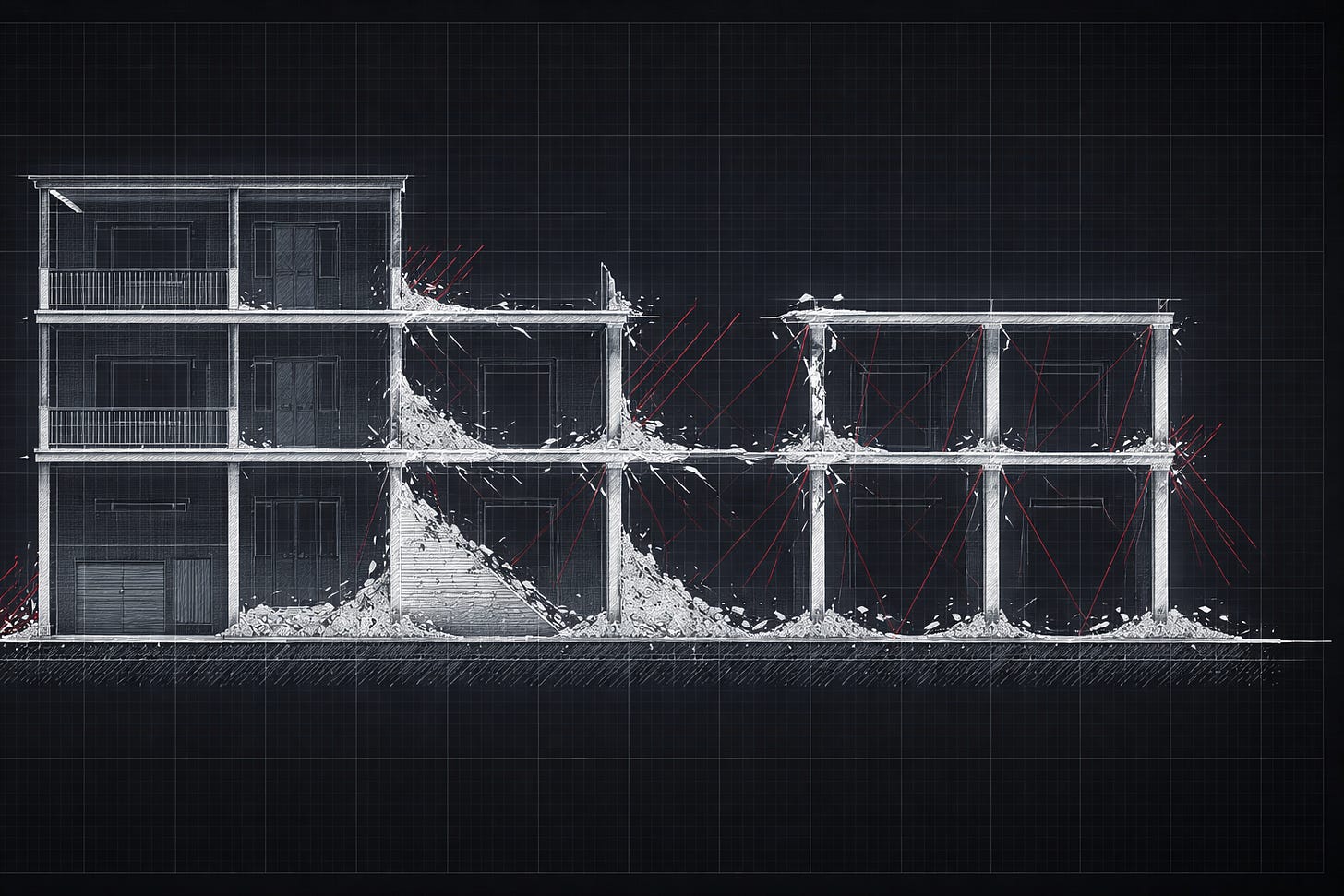

This is what I mean by walls that preserve. Chapter 11 doesn’t kill a company. It reorganizes. It says stop, fix this, continue under conditions. Brutal, but functional. Trump lost equity, lost control, lost face—but the system kept operating. The wall imposed what internal judgment would have imposed, if internal judgment existed.

He learned nothing from this. It’s architectural. There was nothing inside that would encode the lesson. But he adapted—which is different from learning.

He adapted by moving up a level of abstraction. From operating businesses to licensing his name. If you don’t run the casinos, you can’t bankrupt the casinos. The drive remained; the exposure to walls diminished. Someone else hit the walls. He kept the check.

The adaptation is the thing to watch. Each cycle, the pattern finds an environment with less friction.

Fred: friction before contact. Proactive, human, daily.

Bankruptcy courts: friction at contact. Reactive, institutional, fast.

Brand licensing: friction transferred. Someone else’s problem.

Then politics. And here the adaptation accelerated, because political friction is softer than financial friction. Courts move slowly. Congress requires majorities. Media opposition can be metabolized into grievance. Shame—the internal friction most people carry—doesn’t register.

The first term had walls. Softer than bankruptcy courts, but present. Impeachments that didn’t remove. Investigations that slowed but didn’t stop. Advisors who resigned rather than enabled. And finally an election that said no.

But watch what happened between terms. The adaptation continued. Every source of friction, identified and targeted. Courts were slow, so get loyalists on the bench. Congress resisted, so make resistance a career-ender. Media opposed, so discredit media. Advisors constrained, so select for loyalty over competence.

The second term is the environment the pattern has been adapting toward for fifty years. Friction systematically removed. The people who would say no, gone. The institutions that would slow things down, captured or gutted. The bureaucratic knowledge that would complicate execution, walked out the door.

On January 24, 2025—his fifth day in office—the pattern produced a receipt.

At 10 p.m. on a Friday, emails went out from the White House personnel office to seventeen inspectors general across the federal government. The message was identical: “Due to changing priorities, your position is terminated, effective immediately.” Defense. State. Veterans Affairs. Transportation. The offices designed, post-Watergate, to be independent checks on executive misconduct—gone in a single evening.

Federal law requires thirty days’ notice to Congress before firing an inspector general. The law exists because Richard Nixon taught us what happens when a president can eliminate oversight at will. The notice wasn’t given. Senator Chuck Grassley, Republican, chair of the Judiciary Committee, confirmed it publicly the next morning: the required notice “was not provided to Congress.”

Most of the fired inspectors general were Trump’s own appointees from his first term. That’s the part that clarifies the architecture. This wasn’t about who they were. It was about what they could do. They could investigate. They could document. They could create friction at contact. So they had to go.

“It’s a widespread massacre,” one of the fired officials told the Washington Post. “Whoever Trump puts in now will be viewed as loyalists, and that undermines the entire system.”

The system was the point. The wall had to go.

Compare: Fred sending a lawyer to buy $3.5 million in chips, keeping the drive solvent for one more interest payment. That was a father providing external structure his son’s cognition required. This is the inverse: a president eliminating external structure before it can impose anything. Same architecture, opposite vector. Fred built walls to preserve. This removes walls that might stop.

Susie Wiles isn’t Fred. She’s not a bankruptcy court either.

She told Vanity Fair she had a “loose agreement” that the retribution would end after ninety days. It didn’t. She said tariffs were “more painful than anticipated.” They continued. Then she called the piece a “hit job” and the administration rallied around her.

The Lincoln Project’s read: she’s writing her plea bargain with history. Pre-positioning for aftermath. She’s close enough to see the trajectory, and she knows what she isn’t.

She’s not the wall. She’s the lubricant—she makes the drive operational, not by constraining it but by making it run smoother. The Fred role doesn’t exist in this configuration. The bankruptcy role doesn’t exist either. What exists is facilitation. And what remains as external constraint is distant, slow, or catastrophic.

In April, the bond market got his attention.

After “Liberation Day” tariffs sent markets into freefall, after stocks and bonds declined together—a pattern so unusual it’s associated with moments like 2008—after Republican allies called warning of economic disaster, Trump paused.

“People were getting a little queasy,” he said.

The bond vigilantes made him blink. That’s a wall. It can’t be captured, can’t be spun, can’t be loyalty-tested. It responds to math. The closest thing to a functioning external constraint currently operating.

But it only produced a pause. Ninety days. The underlying drive continues. The tariffs on China escalated. The trajectory adjusted, then resumed.

Here is what I’ve come to see, watching fifty years condensed into pattern:

The drive doesn’t learn. It adapts.

Each wall contact doesn’t teach a lesson. It teaches the drive where the walls are. Then the adaptation removes them or routes around them.

Fred was a wall. He died.

Bankruptcy courts were walls. He moved to licensing, where someone else hits them.

Political institutions were walls. He spent four years mapping them, then a second term dismantling them.

Inspectors general were walls. On his fifth night back, he fired seventeen of them.

The velocity is real. Not because he’s getting faster—he’s the same man he was at thirty. But the environment has progressively less friction. Each cycle strips more away.

And now the question is simple, if terrible: what walls remain?

Bond markets. International counterparties who can’t be captured by domestic politics. Economic reality that can be denied but not avoided. Biological limits that no adaptation outruns.

These walls don’t preserve. They don’t say stop, restructure, continue under conditions.

They terminate. Or they break things at a scale we haven’t seen.

That’s not prediction. I’m not saying what will happen or when.

I’m saying: this is the architecture. Fifty years of documented pattern. This is what it means for a mind with no internal gating to have systematically removed external gating.

The drive doesn’t recognize “you can’t.” It only recognizes walls that stop it.

And the walls that remain don’t stop. They end.

If you’re watching for trajectory change, don’t watch for learning. Watch for walls. Not rhetoric. Not polls. Not investigations that take years. Math—the kind that can’t be spun. The bond market spoke once. The question is whether anything speaks again before the remaining walls are the ones that don’t preserve.